Calculate paycheck after 401k contribution

See what happens when you increase your contributions. Held an approximate 65 trillion in retirement assets according to the Investment Company Institute.

401k Contribution Impact On Take Home Pay Tpc 401 K

Some employers even offer contribution matching.

. This article will discuss how much you can contribute to your self-employed 401k plan. Under the Before Tax Adjustments section enter any qualifying 401k percentage or HSA contribution amounts that are being withheld from your paycheck. 401k health insurance HSA etc.

You still have to pay some FICA taxes Medicare and Social Security on your. A self-employed 401k plan is a great way to save for retirement if you are an entrepreneur or solopreneur. Contribute to your 401k.

Accessed Apr 3 2022. In fact if you know the latest inflation numbers it is possible to calculate the increase even before the IRS announces it in October or November. 401k Contribution Calculator Contributing to your workplace 401k is one of the best investment decisions you can make.

SmartAssets North Carolina paycheck calculator shows your hourly and salary income after federal state and local taxes. Try to meet or exceed their matching amount to make the most of your retirement savings. The maximum catch-up contribution available is 6500 for.

If your employer offers a 401k plan consider contributing pre-tax money with every paycheck. How do you calculate net worth. It takes into account your existing balance annual raises in your salary your employers contributions and the estimated rate of return.

An employer-sponsored 401k retirement. A person who lives paycheck-to-paycheck can calculate how much they will have available to pay next months rent and expenses by using their take-home-paycheck amount. Medicare tax rate is 145 total including employer contribution.

For 2021 the IRS says you can contribute up to 61000 in your self-employed 401k plan. The closer you get to October the more accurate your projection can. 290 for incomes below the threshold amounts shown in the table.

Inflation has exploded in the first half of 2022 all the way up to 91 in July so the 2023 contribution limits for many of these accounts will be increased. Our free 401k Calculator for Excel can help you estimate how much you could have after investing for a certain number of years. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

A self-employed 401k plan is also know as a Solo 401k plan. You may now make an additional pre-tax contribution to your plan if you reach age 50 during the calendar year and have reached either the plans or the IRS pre-tax contribution limit. The annual contribution limit is per person and it applies to all of your 401k account contributions in total.

As of 2020 the 401k contribution limit for those aged 50 and below is 19500. There are a number of retirement accounts that allow you to save and invest toward your retirement goals but one of the most common in the US. Long Term Disability Insurance Life.

As of September 2020 401k plans in the US. Wonder what your 401k balance could be by the time you retire. Under the After Tax Adjustments section select your state or enter your state income tax rate enter any after-tax deductions health insurance premiums dental plan premiums etc.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. A person can bring home a big paycheck but have a low net worth if they spend most of their money. Youll be taking advantage of dollar-cost averaging tax-deferred growth and a possible company match.

Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs.

401k Contribution Impact On Take Home Pay Tpc 401 K

Solo 401k Contribution Limits And Types

Free 401k Calculator For Excel Calculate Your 401k Savings

Strategies For Contributing The Maximum To Your 401k Each Year

How Much Can I Contribute To My Self Employed 401k Plan

Corporation Calculating My Solo 401k Contributions For A Corporation My Solo 401k Financial

401 K Calculator Paycheck Tools National Payroll Week

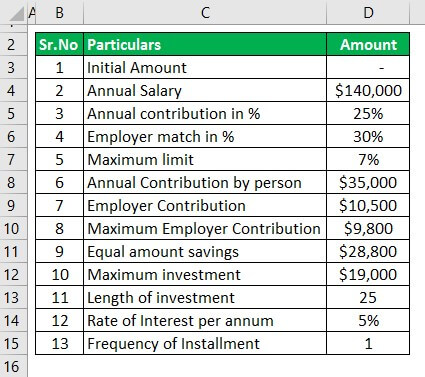

401k Contribution Calculator Step By Step Guide With Examples

Solo 401k Contribution Limits And Types

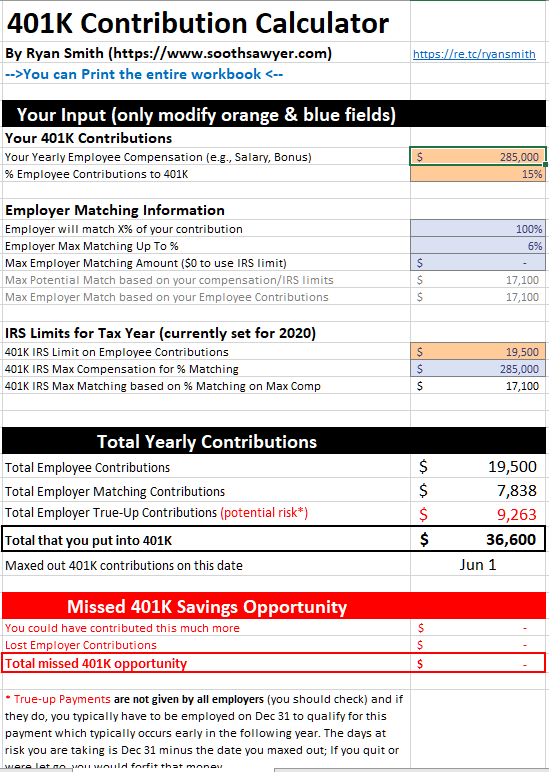

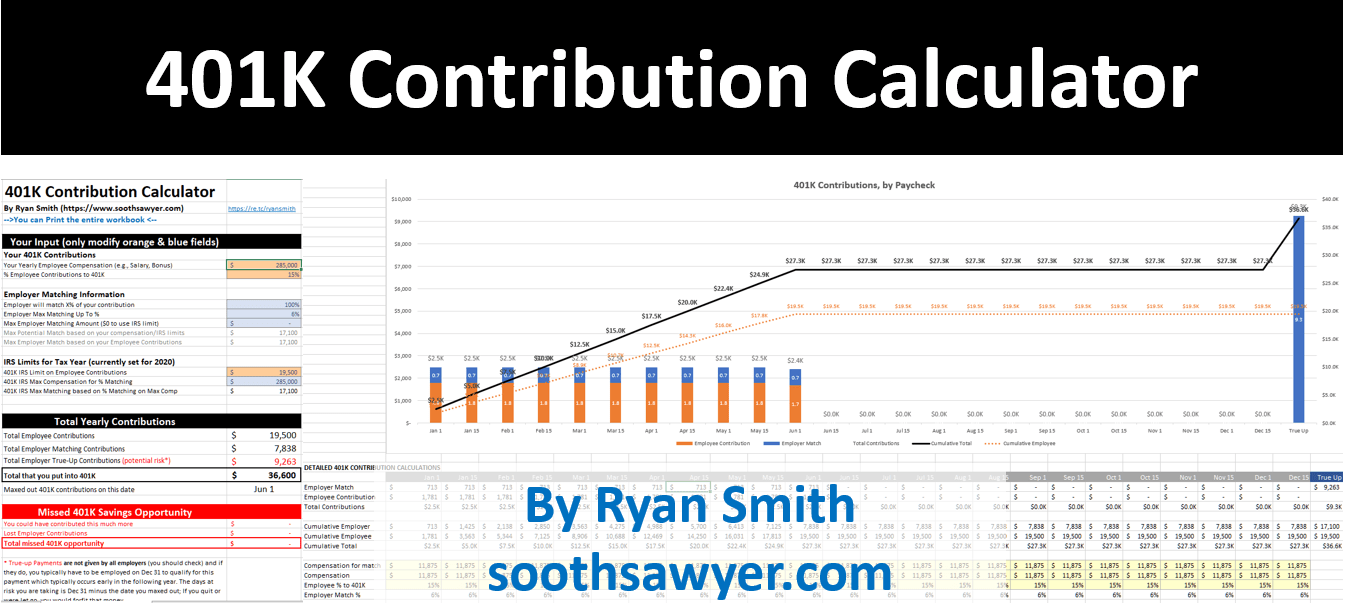

401k Employee Contribution Calculator Soothsawyer

Excel 401 K Value Estimation Youtube

After Tax Contributions 2021 Blakely Walters

Solo 401k Contribution Limits And Types

401k Employee Contribution Calculator Soothsawyer

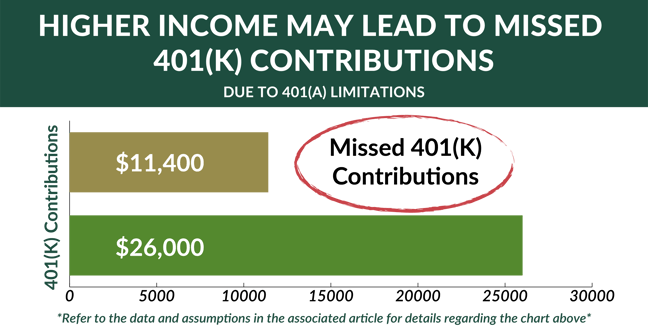

401 K Income Limits The Mistake Executives Earning Over 305 000 Make All The Time

401 K Plan What Is A 401 K And How Does It Work

What Is A 401 K Match Onplane Financial Advisors