Agi calculator 2020

Enter your filing status income deductions and credits and we will estimate your total taxes. Here is how you can calculate your AGI taxable income most easily.

Income Tax Bracket Calculator Income Tax Brackets Tax Brackets Filing Taxes

Number of years x with 365 days 365x plus.

. Formula to calculate AGI. For example the age of a person that has lived for 3 years and 11 months is 3 and the. One of the first steps in filing your income.

1040 Tax Estimation Calculator for 2020 Taxes. Number of years y with 366 days 366y plus. 1 Click File on the left menu box.

Based on your projected tax withholding for the. Your final income number or taxable income. Begin with your grosstotal income.

Donors can deduct qualified cash gifts up to 100 of AGI for 2020 an increase from previous years thanks to the coronavirus stimulus bill. Examples for how to calculate AGI. Refer lines 7-22 of Form 1040 for Income 2.

In this system age grows at the birthday. But if your AGI is 50000 the reduction is only 3750. Sum all the amounts as.

It is mainly intended for residents of the US. Number of days in the remaining partial year. First you will have to gather your income and tax statements.

You must reduce your deduction by 7500. Feb 04 2020 Its not uncommon for the modified AGI and original AGI to be the same number. Enter current date Enter birth date.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Your AGI is the total amount of income you make in a year minus certain expenses that you are allowed to deduct. This calculator is based on the most common age system.

Here are two examples for calculating AGI. And is based on the tax brackets of 2021 and. The first step in computing your AGI is to determine your total gross income for the year which includes your salary in addition to any earnings from self-employment ventures and.

Differences Between AGI MAGI and Taxable Income. Your income will include. The simple steps involved in calculating your AGI from the information given on W-2 are.

Limited to expenses above. MAGI calculator helps you estimate your modified adjusted gross income to determine your eligibility for certain tax benefits and government-subsidized health programs. Your AGI is not the income figure on which the IRS will actually tax you.

5 Adjusted gross income is your taxable income for the year so. It not only determines your tax bracket but also tells you which credits. Published April 14 2020.

How Income Taxes Are Calculated. So if you report 10000 in medical expenses and an AGI of 100000. 2 You will see your refundbalance due amount.

You can use AGI to calculate. How AGI is used to calculate taxes. Once you have your 2020 AGI sign into your tax return and follow the instructions below.

Your age in total number of days is calculated as. The tax calculator provides a full step by step breakdown and analysis of each. Adjusted gross income AGI or your income minus deductions is important when calculating your total tax liability.

Our online Annual tax calculator will automatically work out all your deductions based on your Annual pay. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Sjix7w Zsd4 Mm

Online Classes For Photography Businesses Mentorship

The Only Rental Property Calculator You Ll Ever Need Fortunebuilders In 2020 Rental Rental Property Capitalization Rate

Excel Formula Income Tax Bracket Calculation Exceljet

Pin On Usa Tax Code Blog

Pin On Products

Cash Flow Formula How To Calculate Cash Flow With Examples Cash Flow Positive Cash Flow Formula

Employee Cost Calculator Updated 2022 Employee Cost Calculation

Agi Calculator Adjusted Gross Income Calculator

Free Income Tax Calculator For Ay 2019 20 2020 21 Eztax In Help Filing Taxes Accounting Accounting Software

Taxcaster Free Tax Calculator Estimate Your Tax Refund Turbotax Tax Refund Turbotax Tax

Earned Income Credit Eic Table 2020 2021 Free Tax Filing Tax Time Tax Refund

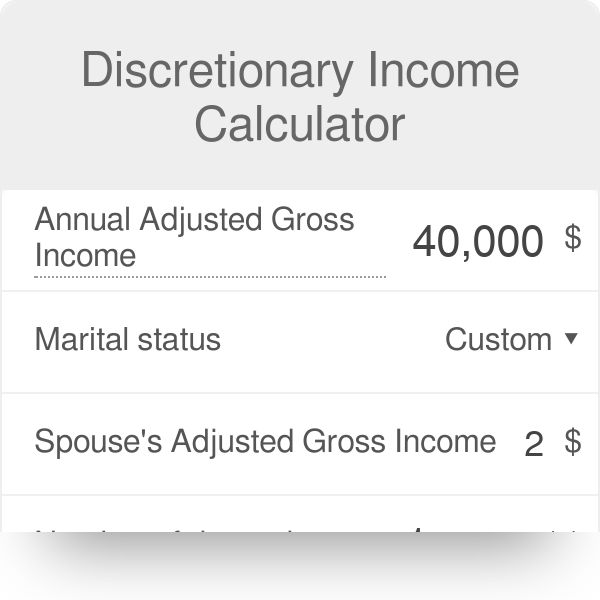

Discretionary Income Calculator

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return

A New Report Analyzes How Each State Taxes Or Does Not Tax Social Security Income Social Security Benefits State Tax Social Security

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Retirement Withdrawal Calculator How Long Will Your Savings Last In Retirement Updated For 2020 Investing For Retirement Personal Finance Lessons Spending Money Wisely